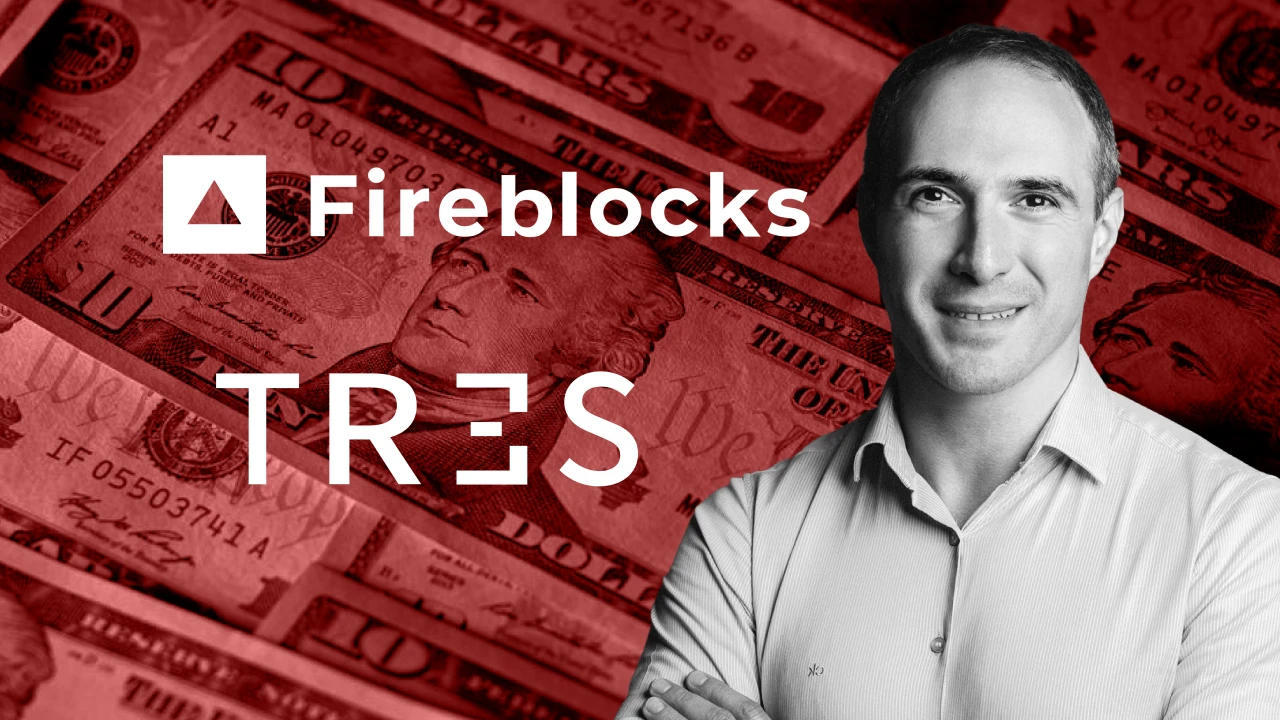

Fireblocks Acquires TRES Accounting Platform for $130M

Fireblocks has entered into an agreement to acquire TRES Finance, an enterprise accounting and financial reporting platform for digital assets, in a transaction valued at $130 million. The deal, structured as a combination of cash and equity, represents Fireblocks' second acquisition in just three months.

The Tel Aviv and New York-based infrastructure company, which facilitates more than $4 trillion in digital asset transfers annually, aims to address mounting regulatory demands by integrating TRES's accounting capabilities into its existing custody and transfer platform.

TRES Finance will continue to operate as a standalone product while becoming part of Fireblocks' broader ecosystem.

Regulatory Pressure Drives Consolidation

The acquisition comes as digital asset firms face intensifying scrutiny from regulators worldwide. The European Union's Markets in Crypto-Assets (MiCA) framework and the proposed GENIUS Act in the United States mandate stricter financial reporting standards for cryptocurrency businesses, requiring audit-ready records and comprehensive tax compliance documentation.

"Both crypto-native firms and traditional institutions need clear, accurate accounting and auditability," Michael Shaulov, co-founder and CEO of Fireblocks, said in a statement.

Shaulov further noted that the combined platform would enable customers to manage operations and back-office finance through a single system.

Founded in 2022, TRES serves more than 230 clients including venture capital firm CoinFund, analytics provider Nansen, and wallet developer Phantom, according to Fireblocks’ January 7 release.

The platform automates reconciliation and reporting across 280 blockchains, exchanges, and custodians, monitoring over $235 billion in assets.

Fireblocks’ Aggressive Expansion

The deal marks a strategic shift for Fireblocks, which was valued at $8 billion in its 2022 funding round. While the company's core business focuses on secure custody and transaction infrastructure, it previously lacked native accounting and analytics capabilities to meet growing institutional demands for treasury management tools.

Tal Zackon, co-founder and CEO of TRES Finance, reiterated that the platform raised $11 million in late 2023 and that the acquisition price represented a premium over its most recent valuation.

"We believe that we will be able to create a much broader treasury management solution that is kind of full spectrum," Shaulov told Fortune, describing plans to integrate transaction execution with financial reporting workflows.

The acquisition follows Fireblocks' October 2025 purchase of wallet infrastructure provider Dynamic for approximately $90 million.

The back-to-back transactions underscore the company's push to build end-to-end infrastructure as institutional adoption accelerates.

Sources

- PRNewswire: Fireblocks Acquires TRES Finance to Deliver the First Unified Operating System for Digital Assets

- Fireblocks: Fireblocks Acquires TRES: Delivering the First Complete Operating System for Digital Assets

- Yahoo Finance: Fireblocks Acquires TRES for $130M to Boost Crypto Tax Compliance

- Bitcoin[.]com: Fireblocks Acquires Tres Finance to Deliver Institutional Digital‑Asset Operating System With Stablecoin Support

- Fortune: Exclusive: Fireblocks acquires crypto accounting platform TRES Finance for $130 million

- TRES: TRES Raises $11M in Series A Funding Round

[Disclaimer: The content of this article is intended for entertainment and educational purposes only. No content published by Block319 is intended to constitute financial advice or advice of any kind. Block319 will not be liable for any losses incurred as a result of interacting with any platforms, products or services mentioned in this article. The blockchain industry is always risky. Always do your own research before engaging with any platform, product or service. If you believe the information included in this article is incorrect, please send an email to info@block319.com and we will endeavour to respond as soon as possible.]