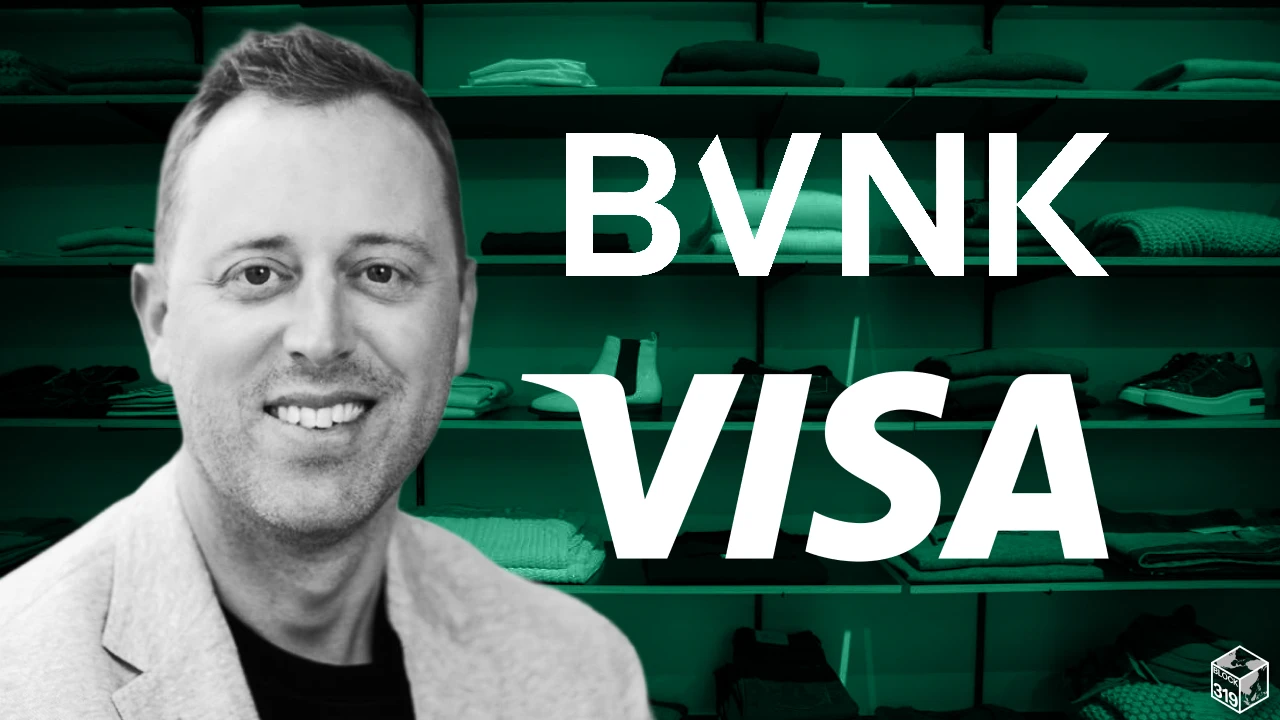

BVNK to Power Stablecoin Settlements for Visa’s $1.7 Trillion Money Network

Visa has entered into a strategic partnership with stablecoin infrastructure provider BVNK to integrate digital asset payments into Visa Direct, the company’s real-time money movement network.

The collaboration aims to modernize how businesses move funds globally by leveraging blockchain-based ‘digital dollars’ for pre-funding and recipient payouts.

Under the agreement, BVNK will provide the underlying infrastructure to support stablecoin services within select markets. The integration itself allows eligible business customers to pre-fund Visa Direct transactions using stablecoins instead of traditional fiat currency. The partnership also enables payouts to be sent directly to end recipients in stablecoins, delivering funds into digital wallets in real-time.

Visa Direct currently processes approximately $1.7 trillion in annual volume, reaching bank accounts, cards, and wallets across more than 190 countries.

By incorporating BVNK’s infrastructure, which handles over $30 billion in stablecoin payments already, Visa intends to offer greater flexibility for cross-border commerce, particularly during weekends and holidays when traditional banking systems are offline.

Visa x BVNK: A Budding Relationship

The partnership marks a significant expansion of the existing relationship between the two firms. Visa Ventures initially invested in BVNK in May 2025, tacitly identifying the firm as a key player in the emerging stablecoin financial stack.

"Stablecoins are an exciting opportunity for global payments, with enormous potential to reduce friction and expand access to faster, more efficient payment options," said Mark Nelsen, Global Head of Product, Commercial & Money Movement Solutions at Visa.

He noted that the partnership is designed to provide the ‘reliable, trusted and necessary infrastructure’ required to scale Visa’s stablecoin pilots.

Jesse Hemson-Struthers, CEO of BVNK, at the same time characterized the move as a foundational shift for the industry:

"This partnership is unlocking a new layer of payment innovation where stablecoins will be embedded directly into the world’s most trusted payments network”

Why It Matters

This development is a landmark moment for institutional blockchain adoption for several reasons, summarized below:

- 24/7 Liquidity: By allowing businesses to pre-fund payouts with stablecoins, Visa bypasses the limitations of the traditional 9-5 banking window, enabling liquidity management that operates around the clock.

- Mainstream Integration: Integrating stablecoin rails directly into a $1.7 trillion network signals that digital assets are moving from the periphery of finance to its core infrastructure.

- Operational Efficiency: For multinational corporations, the ability to settle in digital dollars reduces the reliance on complex intermediary banking relationships, potentially lowering costs and increasing settlement speeds for global payroll and gig economy payments.

Per the announcement, the rollout will initially focus on regions with high demand for digital asset payments before expanding globally based on regulatory approvals and customer needs.

Sources

- BusinessWire: BVNK to Deliver Stablecoin Infrastructure for Visa Direct Pilot Programs

- Cryptopolitan: Visa adds stablecoin payouts to global payments network in BVNK deal

- BVNK: Stablecoins became core financial infrastructure in 2025

- BVNK: Visa invests in BVNK: Accelerating our vision for stablecoin payments infrastructure

[Disclaimer: The content of this article is intended for entertainment and educational purposes only. No content published by Block319 is intended to constitute financial advice or advice of any kind. Block319 will not be liable for any losses incurred as a result of interacting with any platforms, products or services mentioned in this article. The blockchain industry is always risky. Always do your own research before engaging with any platform, product or service. If you believe the information included in this article is incorrect, please send an email to info@block319.com and we will endeavour to respond as soon as possible.]